What Is The Exemption Amount For 2025. Washington — today the irs announced that individuals taking advantage of the increased gift and estate tax exclusion amounts in effect from 2018 to. It is important to note that the increased federal exemption amounts scheduled to expire on december 25, 2025, under the 2017 tax cuts and jobs act.

In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025). What is the maximum gift amount for 2025.

What Happens When the Current Gift and Estate Tax Exemption Sunsets in, The federal lifetime gift and estate tax exclusion will increase from $12.06 million in 2025 to $12.92 million for 2025. Washington — today the irs announced that individuals taking advantage of the increased gift and estate tax exclusion amounts in effect from 2018 to.

Historical Estate Tax Exemption Amounts And Tax Rates, The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all. What is the maximum gift amount for 2025.

Financial Infographics Solution, The full budget for the financial year 2025 (fy24) is just a few weeks away, with taxpayers across the nation hoping for tax relief. You can claim lta for maximum 2 travels in a block of 4 years.

Preparing for the Estate and Gift Lifetime Tax Exemption Sunset (2025), The full budget for the financial year 2025 (fy24) is just a few weeks away, with taxpayers across the nation hoping for tax relief. Budget 2025 section 80d exemption:

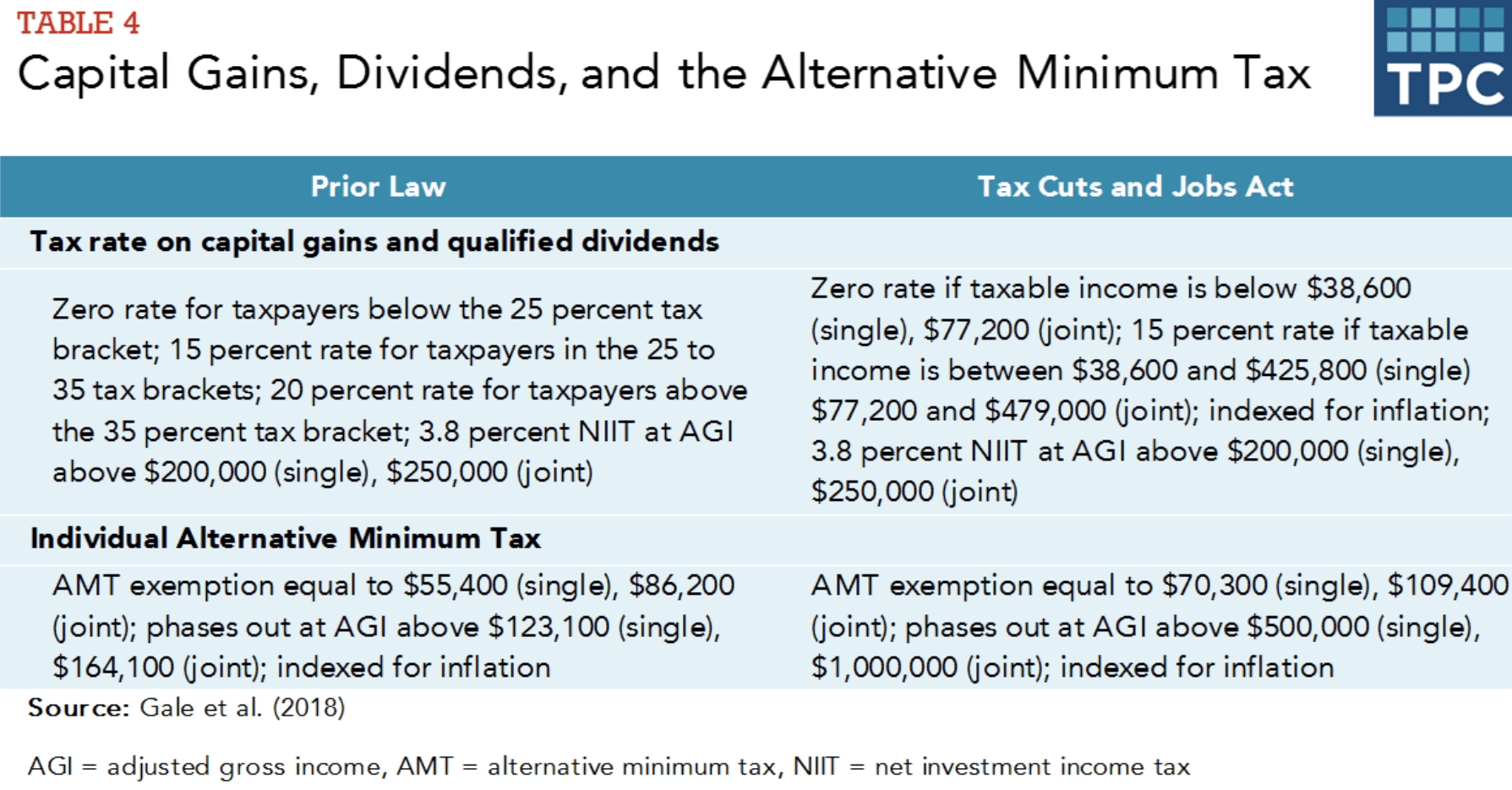

Personal Exemption and Standard Deduction Tax Policy Center, To boost disposable income in the hands of taxpayers, the government may increase the standard deduction amount from rs 50,000 to rs 1 lakh, the report said,. The exemption increased from $5.49 million in 2017 to.

Illinois Property Assessment Institute Homestead Exemptions, The lifetime estate and gift tax exemption for 2025 deaths is $12,920,000. Australia’s east coast gas market is forecast to have a surplus of between 69 and 110 petajoules in 2025 if queensland’s lng producers.

What do the 2025 costofliving adjustment numbers mean for you, Individuals who make lifetime gifts after 2017 and die after 2025. Washington — the treasury department and the internal revenue service today issued final regulations confirming that individuals taking advantage of the.

when does current estate tax exemption sunset Superiorly History, Australia’s east coast gas market is forecast to have a surplus of between 69 and 110 petajoules in 2025 if queensland’s lng producers. Individuals who make lifetime gifts after 2017 and die after 2025.

2025 H1B Cap Exemption A Guide for Healthcare Employers, Let us understand more about. In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

Changes in the Tax Exempt Legislation Douglas Total Financial Solutions, The federal estate tax exemption is the amount excluded from estate tax when a person dies. Each year, the number increases slightly to.

Income from salary is the sum of basic salary + hra + special allowance + transport allowance + any other allowance.